The fast fashion jewelry industry has perfected a unique alchemy of speed and economy, transforming fleeting runway trends into accessible accessories within weeks. This rapid-fire production cycle hinges on a meticulously orchestrated supply chain, a complex web of processes designed for maximum efficiency and minimal cost. Unlike traditional jewelry sectors that operate on seasonal collections, fast fashion brands thrive on a constant churn of newness, delivering fresh designs to consumers at an unprecedented pace. The entire system is a masterclass in logistical precision, from the initial spark of a trend to the final product landing on a store shelf, all while maintaining remarkably low price points that democratize fashion for a mass audience.

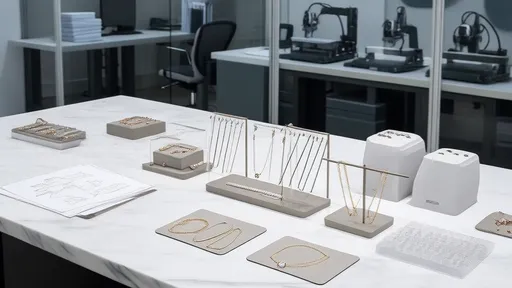

At the very core of this operational model lies agile design and trend forecasting. Dedicated teams of trendspotters and designers constantly scan the fashion landscape, drawing inspiration from high-fashion catwalks, celebrity culture, social media influencers, and even street style. This intelligence is rapidly translated into technical sketches and digital designs. The use of computer-aided design (CAD) software is ubiquitous, allowing for quick modifications and precise specifications that can be instantly shared with manufacturing partners across the globe. This digital-first approach eliminates the time-consuming process of creating physical prototypes for every design, slashing both development time and associated costs.

The selection of materials is a critical factor in achieving the low-cost objective. Fast fashion jewelry predominantly utilizes non-precious metals and alloys such as brass, copper, and zinc, often with a thin layer of gold, silver, or rose gold plating to achieve a desirable aesthetic. Stones are typically synthetic—cubic zirconia, acrylic, or resin—mimicking the look of precious gems without the exorbitant price tag. Sourcing these materials is a global endeavor, with brands often partnering with large-scale suppliers in countries like China, India, and Turkey, where bulk purchasing power drives prices down to a fraction of what precious materials would cost. This strategic compromise on raw material value is the primary enabler of the sector's accessible pricing.

Manufacturing is almost exclusively outsourced to specialized factories in low-cost production hubs, particularly in Asia. Regions in China, such as Yiwu and Guangzhou, host immense industrial clusters dedicated to fashion jewelry production. These facilities are equipped for high-volume output and possess the flexibility to switch between product lines with minimal downtime. The production process itself is highly optimized, often involving mass-production techniques like casting and stamping to create components quickly and uniformly. Labor, a significant cost driver in other industries, remains comparatively inexpensive in these regions, further compressing the final cost of each piece. The close geographical proximity of material suppliers to these manufacturing hubs also reduces logistics time and expenses for raw material transportation.

Perhaps the most defining feature of the fast fashion jewelry supply chain is its revolutionary approach to inventory management. Brands have largely abandoned the traditional model of producing large quantities of a single design in favor of small-batch production runs. A new design might initially be produced in a limited quantity of a few hundred units. This strategy serves as a real-time market test; items that sell out quickly are identified as "winners" and can be re-ordered and restocked in a matter of days. Items with slower sales are simply discontinued, preventing costly markdowns and excess inventory that plagues slower-moving retailers. This demand-driven, just-in-time model drastically reduces waste and financial risk.

Logistics and distribution form the critical artery that pumps product from factory to consumer with breakneck speed. To circumvent the slow pace of maritime shipping, a significant volume of fast fashion jewelry is transported via air freight. While more expensive per unit, the cost is amortized over the high volume of goods and is justified by the immense value of getting new products to market weeks ahead of competitors who ship by sea. Upon arrival at central distribution centers, advanced sorting systems and automation enable rapid order fulfillment. For e-commerce, orders are packed and dispatched within hours. For brick-and-mortar stores, sophisticated algorithms determine allocation, ensuring the right products reach the right stores based on real-time sales data and regional trend preferences.

The retail strategy, both online and offline, is engineered to complement the rapid supply chain. Physical stores are designed for frequent visual refreshment, with layouts that can be easily reconfigured to highlight new arrivals. The in-store experience is focused on impulse purchases, with jewelry often displayed at checkout counters or in high-traffic areas. Online, product pages are updated constantly, and digital marketing campaigns on social media platforms create immediate buzz and urgency around new drops. Limited-time offers and flash sales are common tactics to accelerate sell-through and make room for the next wave of products, creating a perpetual cycle of consumer engagement and purchase.

This relentless focus on speed and cost does not come without its significant challenges and growing ethical scrutiny. The environmental footprint, from the mining of base metals to the energy-intensive nature of global air freight, is substantial. Furthermore, the pressure to keep costs exceedingly low can sometimes lead to questionable labor practices within the supply chain, including poor working conditions and low wages in some factories. In response to increasing consumer awareness, a segment of the industry is beginning to explore more sustainable materials, such as recycled metals and bio-based resins, and is investing in audits to improve ethical transparency. However, reconciling the fundamental economics of fast fashion with truly sustainable practices remains the sector's greatest dilemma.

In conclusion, the ability of fast fashion jewelry brands to achieve both low costs and rapid new product launches is not the result of a single magic bullet but rather the seamless integration of multiple, highly optimized strategies. It is a symphony of agile design, cost-effective material sourcing, centralized mass production, risk-averse small-batch manufacturing, and hyper-efficient logistics. This integrated supply chain model has fundamentally reshaped consumer expectations, creating a market that craves constant novelty at an accessible price. As the industry evolves, the next chapter will likely be defined by its ability to innovate not just in speed and cost, but in integrating sustainability and ethics into this incredibly efficient, yet demanding, operational framework.

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025

By /Aug 27, 2025